Donald Trump has once again set his sights on the Federal Reserve, accusing its chairman Jerome Powell of failing in monetary policy and threatening to fire him. But what lies behind these attacks: a real threat to the Fed's independence, or just another round of political pressure? And how might this affect the markets, the dollar, and the US economy? Let's examine the facts, risks, and possible scenarios.

Why does Trump want Powell gone?

In the political drama unfolding in Washington, the next act centers around the fate of the Federal Reserve.

Donald Trump has brought Jerome Powell back into the spotlight, the man he once appointed the Fed Chairman, now accused of being slow, stubborn, and, perhaps most dangerously for the markets, politically biased.

In a series of public statements, Trump said that Powell "has to go" – and that resignation is just a matter of time and presidential will.

At first glance, there's nothing new in this conflict: Trump has regularly criticized the central bank for not supporting economic growth aggressively enough. But this latest escalation is different in scale and potential consequences. Behind the rhetoric lies not just frustration, but a growing threat to the independence of one of the world's most critical financial institutions.

Trump's latest tirade against Powell has been unusually blunt – even by presidential standards. "If I ask him to go, he'll go," Trump told reporters in the Oval Office, adding that "Powell's resignation can't come soon enough." These words marked a shift from discontent to open pressure on the Fed.

Trump blames Powell for being too slow to cut interest rates and for failing to support the US economy in the face of external challenges. "Everything is coming down – except interest rates," Trump complained, pointing to falling oil and gas prices. "Because we have a Fed chairman who plays politics."

What irritated Trump the most was Powell's refusal to act decisively, even as the global economic outlook worsened and the European Central Bank moved to cut rates. "Jerome Powell at the Fed is always late and always wrong," Trump wrote in a post, accusing Powell of delay and inaction.

This rhetoric fits into a broader pattern of growing political pressure on independent institutions. The Trump administration has already secured the authority to fire members of independent federal boards, raising concerns that the next target could be the Federal Reserve.

Amid trade wars, slowing growth, and increasing tariff pressure, the president is now openly demanding full alignment from economic policymakers. In this light, Powell becomes more than just an official with differing views – he is a symbol of institutional autonomy, something that in today's political atmosphere is perceived as defiance.

The attack on Powell, then, is not just about interest rates – it's about gaining control over the key levers of economic management in a time of growing instability. That's why this conflict has taken on such sharp contours.

Can Trump fire Powell?

Whether a US president can dismiss a Federal Reserve Chair before the end of their term remains a legal gray area. Formally, the Federal Reserve Act states that the chair can be removed only "for cause." But what exactly constitutes cause is an open legal question.

In response to the pressure, Jerome Powell has cautiously reminded in his public remarks that "our independence is a matter of law," emphasizing that removal is only allowed for serious reasons. He also noted that he's closely watching a Supreme Court case involving the dismissal of members of independent federal agencies, as the outcome could have implications for the Fed's autonomy.

Historically, the independence of the Fed chair rests on a 1935 precedent, when the Supreme Court upheld the right of independent agencies to operate without presidential interference, except in cases of serious misconduct.

Still, Trump has shown a willingness to challenge that precedent. Recent dismissals of members from the National Labor Relations Board (NLRB) and the Merit Systems Protection Board (MSPB) have raised alarms about the erosion of boundaries between the White House and independent institutions.

Senator Elizabeth Warren commented: "The president has the right to free speech, like anyone else. But he doesn't have the authority to fire Jerome Powell. And if he tries, he'll tank the markets." Her warning reflects the growing concern among political and expert circles: even the threat of interfering with the Fed could undermine trust in the US financial system.

In practice, any attempt to remove Powell would almost certainly spark prolonged legal battles, judicial reviews, and a political crisis. Moreover, the chance that such a move would go unchallenged is virtually zero: resistance would come not only from Democrats but also from Republicans who view Fed independence as a cornerstone of America's system of checks and balances.

So while Trump's statements are loud, the actual likelihood of Powell being removed is very limited by legal constraints and political fallout. Yet the mere threat of interference has already shaken the perception of institutional stability, and markets are sensing it.

What would the Fed Chair's dismissal mean for markets?

The Federal Reserve holds a unique place in the global financial system. Its independence is viewed not merely as a domestic issue but as a cornerstone of trust in the US dollar, US assets, and global financial stability. That's why any political pressure on the Fed is perceived as a threat not just to one official but to the entire financial architecture.

So far, markets are reacting with restraint. Indexes remain within normal volatility ranges, Treasury yields haven't spiked, and the dollar is holding relatively steady. But this calm is deceptive. Beneath the surface, tension is building, reflected in subtle but significant indicators, such as rising term premiums in bond markets and shifting yield curves.

Investors understand that if the Fed's independence is truly at risk, the consequences could be far-reaching. A loss of confidence in the US central bank could push Treasury yields higher, weaken the dollar, and increase demand for safe havens like gold, the Swiss franc, the Japanese yen, and possibly even the euro. This wouldn't be an immediate crash, but a gradual, steady reallocation of global capital.

As economist Jack McIntyre notes, the "term premium" is already on the rise – investors are demanding higher compensation for holding US assets in the long term. This reflects not macroeconomic concerns, but fading trust in the predictability of US financial policy.

The memory of Trump's trade wars still lingers. Despite early skepticism, the damage turned out to be greater than initially expected: falling stock markets, soaring bond yields, and a weakening dollar. The threat to the Fed is perceived similarly – as a risk that's hard to quantify but potentially very disruptive.

What's at stake is not just Powell's position. The deeper question is the preservation of the basic principles of US financial governance, such as the autonomy of monetary policy and institutional independence.

If these principles are undermined, the market response could be more severe than any short-term reaction to a political headline.

Lessons from the past: what happens when central banks face political pressure?

The issue of political pressure on central banks is nothing new in global history. While today's threat to fire Jerome Powell may seem unprecedented for the United States, there are past examples where government interference in monetary policy led to economic turmoil. These cases offer a crucial lesson: short-term gains can turn into long-term losses.

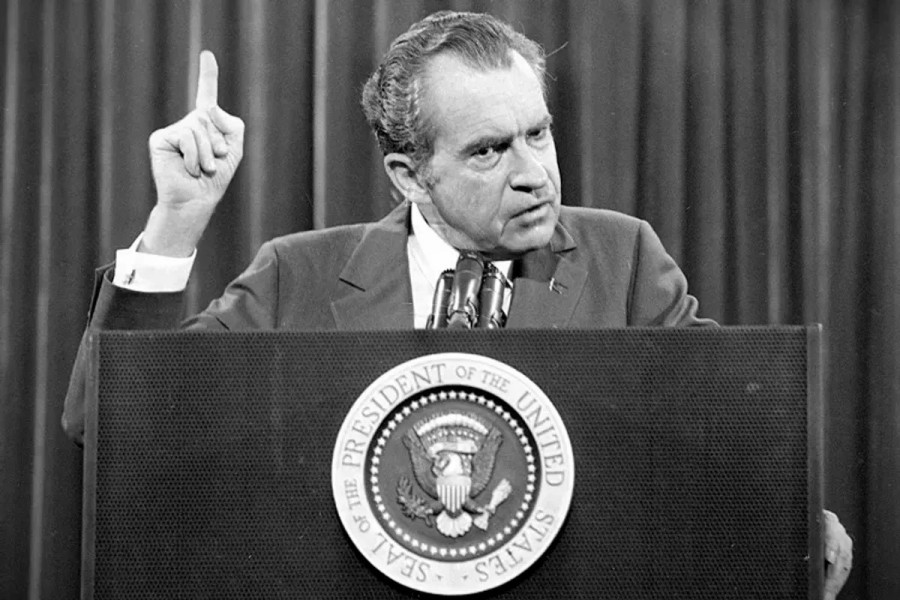

One of the most striking examples comes from the 1970s, when Fed Chair Arthur Burns, who had close ties to President Richard Nixon, succumbed to pressure from the White House and kept interest rates artificially low.

At first, this stimulated the economy and boosted the administration's popularity. But it soon became clear that politically motivated interference would come at a steep cost.

The outcome was dramatic: runaway inflation, a decline in real incomes, a loss of confidence in the dollar, and the need for drastic monetary tightening in the years that followed.

To restore stability, the Federal Reserve under Paul Volcker was forced to raise interest rates to double-digit levels, triggering a painful recession.

History clearly shows: when monetary policy becomes a tool for political expediency, the economy pays a much higher price than any short-term benefit it might gain. Lowering rates under administrative pressure may offer temporary relief, but it undermines confidence in the very system upon which financial market stability is built.

This is precisely what analysts and investors fear today. If Jerome Powell is replaced by a more compliant candidate who prioritizes political ambitions over the Fed's independence, the consequences could mirror past mistakes: a short-term surge in liquidity, a weakening dollar, a spike in inflation, and painful corrections down the line.

In short, history reminds us that central bank independence is not a luxury, but a fundamental condition for stability. And when political interests outweigh economic common sense, the price is only a matter of time.

What experts say: how real are the threats and risks?

While markets remain outwardly calm, analysts are already expressing concern. Many of them view Trump's statements not just as political rhetoric, but as a real source of systemic risk that could change how global investors perceive American assets.

Market strategist Tom Bruce notes that any attempt to fire Powell would likely do more damage to the economy than deliver any short-term benefit.

"The damage from such a move would be too great. More likely, we'll see an attempt to install a 'shadow' chair—someone to whom the administration turns for real signals. But even that setup could further erode trust in the Fed's official policy," he commented.

His colleague Jamie Cox emphasized that replacing the Fed chair under political pressure could destroy the most important asset the US holds in the global economy: trust in the dollar.

"The dollar is America's greatest advantage in global trade. Administrations come and go, but the consequences of bad monetary policy last much longer," he said, adding that weakening confidence in the US currency could shift the global balance of power.

Concerns are further heightened by the fact that even without an actual dismissal, any pressure on the Federal Reserve alters market expectations.

As Rohan Hanna of Barclays notes, the threats against Powell won't change FOMC decisions in the short term, but they could lay the groundwork for a long-term reassessment of risk.

Against this backdrop, more pragmatic assessments are emerging. Analyst Christopher Hodge points out that the political risk linked to interference with the Fed has expanded the range of possible scenarios. While most experts still believe Powell will remain in his post, the former certainty in the stability of monetary policy has already been shaken.

The general sentiment among experts can be summed up as follows: even if Powell is not actually removed, the mere threat of interference has already altered the perception of the Fed as an independent institution. That means markets will begin pricing in a new layer of risk across the dollar, Treasury bonds, and US assets as a whole.

What traders should do: strategies in a politically risky environment

The current situation surrounding the Federal Reserve and the pressure on its leadership signals to traders that they must factor in unconventional risks—risks that not long ago seemed purely theoretical. Even without Jerome Powell's immediate removal, the threat to the Fed's independence is already beginning to reshape market behavior.

In the short term, traders should exercise particular caution with trades involving the dollar and US Treasuries. Potential erosion of trust in the Fed could lead to heightened currency market volatility and a reassessment of Treasury yield expectations. Sharp moves may occur even on relatively neutral macroeconomic data, simply due to shifting risk perceptions.

For equities, more conservative strategies are advisable. Rising political uncertainty typically boosts interest in safe-haven assets—gold, the Swiss franc, and stocks of companies with strong, stable cash flows. The most direct risks are concentrated in the US banking and financial sectors, which are especially sensitive to Fed policy shifts.

Over the medium term, continued pressure on the Fed could trigger a reallocation of global capital flows. For traders, this creates opportunities in emerging markets and alternative currencies that might benefit as the dollar's dominance weakens.

And finally, the most important recommendation: keep a close eye not only on macroeconomic indicators, but also on the political news cycle. In 2025, investment decisions will increasingly be driven not by CPI or GDP numbers, but by the latest headlines out of Washington.

Traders must prepare for turbulence—but remember: where uncertainty rises, so do new opportunities!