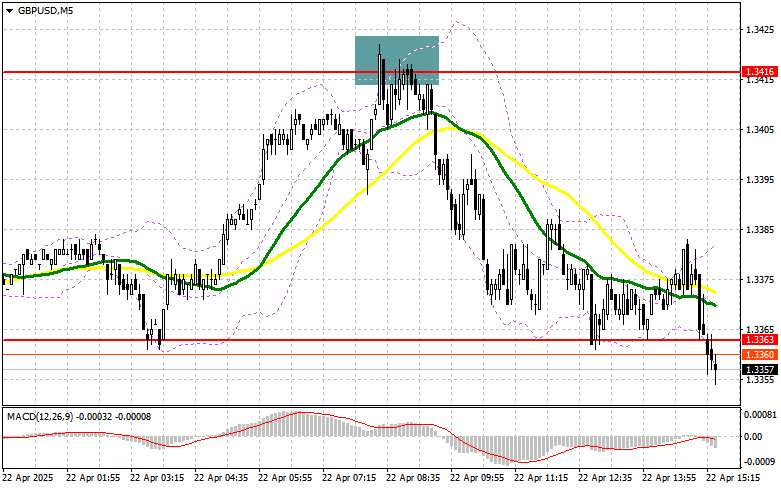

In my morning forecast, I highlighted the 1.3416 level as a key point for market entry. Let's look at the 5-minute chart and break down what happened. The pair climbed and formed a false breakout around 1.3416, providing a solid entry point for short positions, which led to a decline toward the 1.3363 level. The technical outlook for the second half of the day has not changed significantly.

To open long positions on GBP/USD:

The absence of U.K. news allowed the pound to continue climbing, though buyers failed to break above the weekly highs. In the second half of the day, market direction will be shaped by interviews with FOMC members Philip N. Jefferson and Patrick T. Harker. The Richmond Fed Manufacturing Index will also be released, but only strong data are likely to spark a more significant correction in GBP/USD—something I plan to capitalize on.

If the pair declines, I'll act after a false breakout around the same 1.3363 support level, which has already proven reliable. This will provide a good entry point for long positions with a target of retesting resistance at 1.3416—a level that previously proved difficult to break. Only a breakout and retest of this range from above will provide a new long entry point with the prospect of reaching 1.3462, reinforcing the bullish market. The ultimate target is the 1.3510 area, where I plan to take profit.

If GBP/USD falls and buyers show no interest at 1.3363, pressure on the pair will increase. In this case, only a false breakout around 1.3304 will justify long positions. If no rebound is seen there, I will look to buy from 1.3245 for an intraday correction of 30–35 points.

To open short positions on GBP/USD:

Sellers made their presence known around 1.3416 and are now targeting 1.3363. Only a hawkish stance from Fed officials could help push the pair below this level. If the pound rises again in the second half of the day, I plan to act around the same resistance at 1.3416. A false breakout there would provide an entry point for selling, aiming for a decline to support at 1.3363, which is currently being contested. A breakout and retest of this range from below will trigger stop-loss orders and pave the way to 1.3304. The ultimate target is 1.3245, where I will take profit.

If pound demand returns later in the day and bears fail to act around 1.3416, I will postpone shorts until a test of resistance at 1.3462. I'll open short positions there only on a false breakout. If there's no pullback there either, I'll look to short from 1.3510, aiming for a 30–35 point intraday correction.

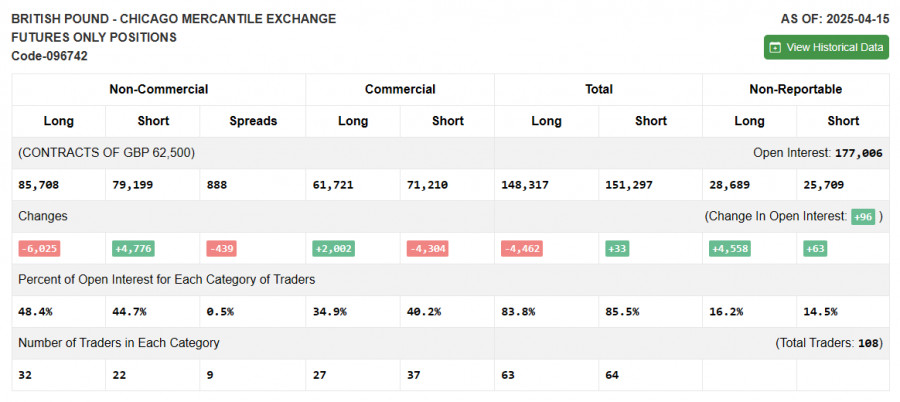

COT Report (Commitment of Traders) – April 15:

The report showed a rise in short positions and a decline in long ones. Interestingly, the pound has continued to grow confidently against the dollar, even with these numbers. However, it's important to understand that this data lags and the recent GBP/USD surge is directly tied to Trump's tariff stance and dissatisfaction with Fed Chair Jerome Powell. These factors weigh more on the dollar than they support the pound. Long non-commercial positions fell by 6,025 to 85,708 and short non-commercial positions increased by 4,776 to 79,199. The net position narrowed by 439.

Indicator Signals:

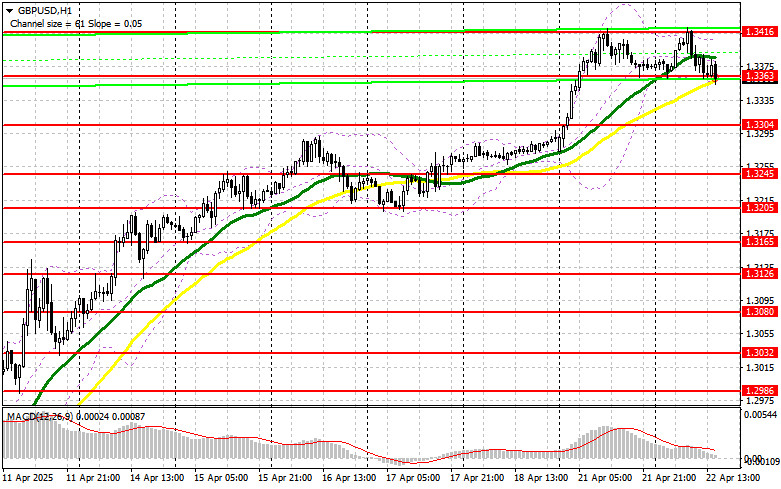

Moving Averages: Trading is occurring above the 30- and 50-period moving averages, signaling the continuation of the pair's upward trend.

Note: The moving average periods and prices are based on the H1 chart as used by the author, and may differ from the classical daily moving averages on the D1 timeframe.

Bollinger Bands: In case of a decline, the lower band near 1.3363 will act as support.

Indicator Descriptions:

- Moving Average: Identifies the current trend by smoothing out volatility and market noise.

- Period 50 (yellow line)

- Period 30 (green line)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – period 12

- Slow EMA – period 26

- SMA – period 9

- Bollinger Bands:

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total open long positions held by non-commercial traders.

- Short non-commercial positions: Total open short positions held by non-commercial traders.

- Net non-commercial position: The difference between long and short non-commercial positions.