Trade Analysis and Tips for Trading the Euro

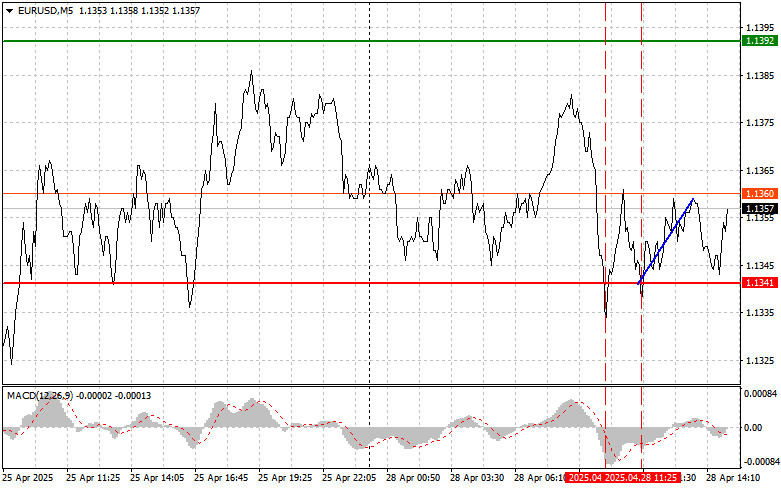

The test of the 1.1341 price level occurred when the MACD indicator had already moved significantly below the zero line, limiting the downward potential of the pair. For this reason, I did not sell the euro. A short time later, another test at 1.1314 occurred, at a moment when the MACD was in oversold territory, allowing Scenario #2 for buying the euro to be realized.

Despite the morning's published data, which predictably did not spark much interest, trading activity remained within a narrower range than anticipated. Market participants seemed to prefer a wait-and-see approach, shifting their focus to more significant upcoming macroeconomic releases. This caution is likely due to the uncertain outlook regarding future interest rate policies, as well as potential geopolitical tensions affecting the global economy. Investors are refraining from decisive actions, seeking clearer guidance on what lies ahead.

Given the lack of U.S. economic publications in the second half of the day, market volatility is likely to continue to decline. Consequently, strong directional movements should not be expected. However, the slowdown in trading activity could offer an opportunity for a deeper analysis of the market situation. The absence of a constant news flow allows for a greater focus on fundamental factors influencing long-term trends. Furthermore, periods of low volatility often precede sharp market swings. Like a compressed spring, the market is accumulating energy for a potential breakout.

As for the intraday strategy, I will continue to rely primarily on the implementation of Scenarios #1 and #2.

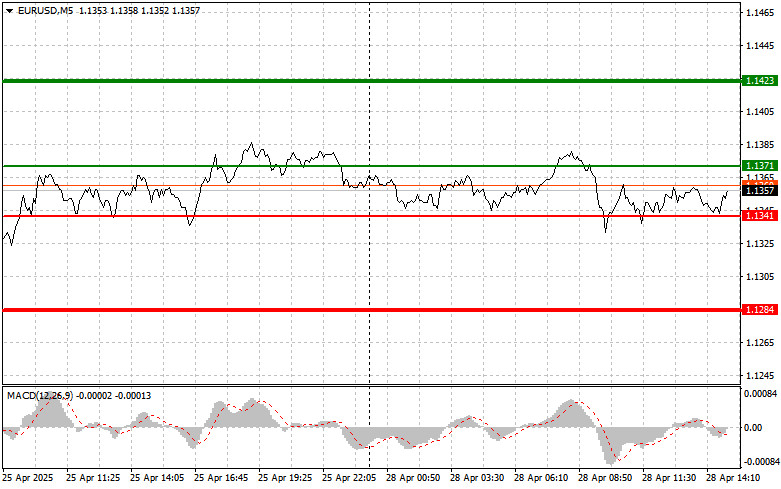

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the 1.1371 level (green line on the chart), with a target of rising to the 1.1422 area. I plan to exit the market at 1.1422 and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Euro growth can be expected in line with the prevailing trend. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1341 level when the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a market reversal to the upside. Growth can be expected towards the 1.1371 and 1.1422 levels.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1340 level (red line on the chart). The target will be the 1.1284 area, where I plan to exit the market and immediately open long positions in the opposite direction (anticipating a 20–25 point move from the entry point). Downward pressure on the pair will likely return if buyers fail to show activity around the daily high. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1371 level when the MACD indicator is in the overbought zone. This would limit the pair's upward potential and trigger a reversal downward. A decline towards the 1.1341 and 1.1284 levels can be expected.

What's on the chart:

- Thin green line — the entry price for buying the trading instrument;

- Thick green line — the estimated price where Take Profit orders can be placed or profits manually secured, as further growth above this level is unlikely;

- Thin red line — the entry price for selling the trading instrument;

- Thick red line — the estimated price where Take Profit orders can be placed or profits manually secured, as further declines below this level are unlikely;

- MACD Indicator: When entering the market, it's important to monitor the overbought and oversold zones.

Important: Beginner traders in the Forex market must exercise extreme caution when deciding to enter the market. Before the release of important fundamental reports, it is advisable to stay out of the market to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly, especially if you are not practicing money management and are trading large volumes. Always remember: successful trading requires a clear trading plan, similar to the one I have outlined above. Making spontaneous trading decisions based on the current market situation is, by default, a losing intraday trading strategy.